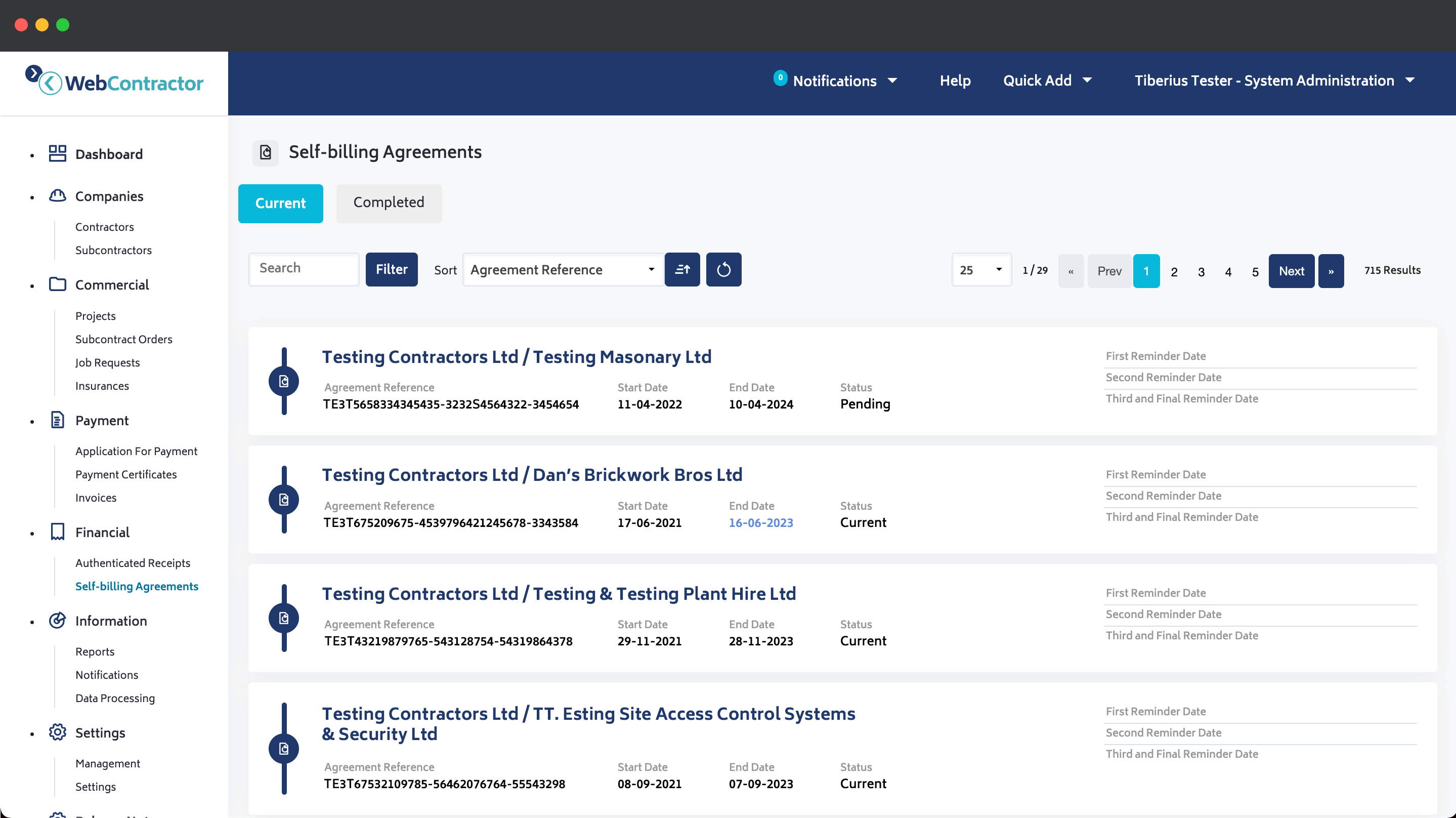

Self-Billing agreements

WebContractor can help reduce the administrative time, effort, and cost of processing Authenticated VAT Receipts [AVRs] by allowing an easy-to-manage, self-billing strategy to be adopted by a contractor.

Manage the issue of electronic self-billing agreements online, using automated workflows and notifications to simplify and speed up the whole process.

Why adopt self-billing agreements for subcontractors?

Where Subcontract Payments are being made between two VAT registered parties, the contractor can produce their Subcontract Payment Certificates and Remittance Advices (as a tax invoice) on a self-bill basis, providing a self-billing Agreement is in place beforehand.

Contractors continually strive to operate their subcontractor payment processes on a lean and efficient basis, and removing costly and unnecessary administration is a perennial challenge.

Module benefits

Streamlined self-billing

Moving to a self-billing strategy and using WebContractor can make the process simple to manage, cheaper to perform and can streamline the experience for both contractors and subcontractors.